Checking & Savings Rates

Checking

Checking

Membership Application| Product Description |

Minimum Balance to earn advertised APY* |

Dividend/Interest Rate | APY * | Term |

|---|---|---|---|---|

| Regular Checking or DBA Checking | $0.00 | 0.00% | 0.00% | N/A |

| $500.00 | 0.05% | 0.05% | N/A |

Annual Dividend Rate may change after the account is opened

| Product Description |

Minimum Balance to earn advertised APY* |

Dividend/ Interest Rate | APY * | Term |

|---|---|---|---|---|

| TIER I | $1,500.00 | 0.10% | 0.10% | N/A |

| TIER II | $5,000.00 | 0.30% | 0.30% | N/A |

| TIER llI | $10,000.00 | 0.40% | 0.40% | N/A |

| TIER IV | $50,000.00 | 0.55% | 0.55% | N/A |

| TIER V | $100,000.00 | 0.65% | 0.65% | N/A |

*Annual Percentage Yield

Savings

Savings

Membership Application| Product Description | Minimum Balance to earn advertised APY* | Dividend/Interest Rate | APY* | Term |

|---|---|---|---|---|

| Regular | $25.00 | 0.05% | 0.05% | N/A |

| Tier ($2,000 – $19,999) | $2,000.00 | 0.10% | 0.10% | N/A |

| Tier ($20,000 – $49,999) | $20,000.00 | 0.15% | 0.15% | N/A |

| Tier ($50,000 – $100,000+) | $50,000.00 | 0.20% | 0.20% | N/A |

| Product Description | Minimum Balance | Dividend/Interest Rate | APY* | Term |

|---|---|---|---|---|

| Christmas or Vacation Club | N/A | 0.05% | 0.05% | N/A |

*Annual Percentage Yield Annual Dividend Rate may change after the account is opened

Regular CDs

| Product Description | Minimum Balance to earn advertised APY* | Max. Limit per Member | Dividend/Interest Rate | APY* |

|---|---|---|---|---|

| 6 Month | $1,000.00 | $250,000.00 |

1.75% |

1.76% |

|

12 Month |

$1,000.00 | $250,000.00 | 1.80% | 1.82% |

| 18 Month | $1,000.00 | $250,000.00 | 2.25% | 2.27% |

| 24 Month | $1,000.00 | $250,000.00 | 2.75% | 2.79% |

| 36 Month | $1,000.00 | $250,000.00 | 2.80% | 2.83% |

| 48 Month | $1,000.00 | $250,000.00 | 3.00% | 3.04% |

| 60 Month | $1,000.00 | $250,000.00 | 3.00% | 3.04% |

*Annual Percentage Yield

The Annual Percentage Yield on Certificates is based on an assumption that dividends will remain on deposit until maturity. A withdrawal of dividends will reduce earnings. We will impose a penalty if you withdraw any of the principal before the maturity date. The amount of the early withdrawal penalty for Certificates with a maturity of one year or less is 90 days worth of dividends. The amount of the early withdrawal penalty for Certificates with a maturity greater than one-year is equal to 180 days worth of dividends.

Traditional and Roth IRA CDs

| Product Description | Minimum Balance to earn the advertised APY* | Max. Limit per Member | Dividend/Interest Rate | APY* |

|---|---|---|---|---|

| IRA Certificates – 12 months | $1,000.00 | $250,000.00 |

1.90% |

1.91% |

| IRA Certificates – 18 months | $1,000.00 | $250,000.00 | 2.35% | 2.38% |

| IRA Certificates – 24 months | $1,000.00 | $250,000.00 | 2.85% |

2.89% |

| IRA Certificates – 36 months | $1,000.00 | $250,000.00 | 2.90% | 2.94% |

| IRA Certificates – 48 months | $1,000.00 | $250,000.00 | 3.10% | 3.14% |

| IRA Certificates – 60 months | $1,000.00 | $250,000.00 |

3.10% |

3.14% |

*Annual Percentage Yield

The Annual Percentage Yield on Certificates is based on an assumption that dividends will remain on deposit until maturity. A withdrawal of dividends will reduce earnings. We will impose a penalty if you withdraw any of the principal before the maturity date. The amount of the early withdrawal penalty for Certificates with a maturity of one year or less is 90 days worth of dividends. The amount of the early withdrawal penalty for Certificates with a maturity greater than one-year is equal to 180 days worth of dividends.

| Product Description | Minimum Balance to earn the advertised APY* | Max. Limit per Member |

Dividend/Interest Rate |

APY* |

|---|---|---|---|---|

| IRA Certificates – 12 months | $1,000.00 | $250,000.00 | 1.90% | 1.91% |

| IRA Certificates -18 months | $1,000.00 | $250,000.00 | 2.35% | 2.38% |

| IRA Certificates -24 months | $1,000.00 | $250,000.00 | 2.85% | 2.89% |

| IRA Certificates -36 months | $1,000.00 | $250,000.00 | 2.90% | 2.94% |

| IRA Certificates -48 months | $1,000.00 | $250,000.00 | 3.10% | 3.14% |

| IRA Certificates -60 months | $1,000.00 | $250,000.00 | 3.10% | 3.14% |

*Annual Percentage Yield

The Annual Percentage Yield on Certificates is based on an assumption that dividends will remain on deposit until maturity. A withdrawal of dividends will reduce earnings. We will impose a penalty if you withdraw any of the principal before the maturity date. The amount of the early withdrawal penalty for Certificates with a maturity of one year or less is 90 days worth of dividends. The amount of the early withdrawal penalty for Certificates with a maturity greater than one-year is equal to 180 days worth of dividends.

Traditional & Roth IRA Shares

| Product Description | Minimum Balance to earn the advertised APY* | APY* |

|---|---|---|

| Traditional or Roth IRA | $0.00 – $24.99 | 0.00% |

| Traditional or Roth IRA | $25.00 – $49,999.99 | 0.20% |

| Traditional or Roth IRA | $50,000.00 – $100,000.00 | 0.35% |

*Annual Percentage Yield

Loan Rates

Mortgage

Fixed Rate Mortgages

Apply NowUp to 97% financing available on single family and 95% financing available for duplex!

| Product | Points | Interest Rate* | APR** |

|---|---|---|---|

| 10 Year Term | 0 | 5.000% | 5.403% |

| 15 Year Term | 0 | 5.125% | 5.409% |

| 20 Year Term | 0 | 5.500% | 5.729% |

| 30 Year Term | 0 | 5.875% | 6.053% |

Construction Loans – Rates may be higher, call for more information.

If your loan is paid off within two years of the closing date, you will reimburse credit union for closing costs paid on your behalf. Other rates and terms available. Offer may be discontinued or changed at any time. Not all applicants will qualify. Homeowner’s insurance is required but not included in amounts for payment example. No closing costs, member is responsible for recording fees. A fixed rate mortgage loan payment based on $10,000 at 5.000% APR for 10 years is $106.07. Homeowners insurance is required on all Mortgage and Equity loan products.

All rates are subject to change. Please call for details. Rates effective as of 09/17/2025.

*Interest rates shown are “as low as,” credit score, property value and loan terms affect final rates.

**APR – Annual Percentage Rate

Equity

Home Equity Line of Credit

Apply NowHELOC SPECIAL – 3.99% APR* 12 Month introductory rate, then prime rate. 1

Up to 80% financing available minus mortgage balance

| Product Description | Interest Rate |

|---|---|

| 15 Year (10 Year Draw) | Prime Rate = Rate Not to go below Floor Rate of 3.00% |

1 This loan has a variable rate feature and has an introductory rate of 3.99% APR* for the initial 12 months and will convert to a variable rate. The variable rate is based on the highest prime rate published in the Wall Street Journal on the first business day of each month. Current prime rate as of 12/11/2025 is 6.75% APR*. The rate will vary. Rate will never exceed 18% APR* and has a floor of 3.00% APR*. Minimum cash out $10,000.00. Maximum loan is $250,000. Minimum monthly payments are based on principal and interest of the amount advanced, amortized within the original 15-year term.

Repayment terms based on a 15-year term at 6.75% APR* (Current Prime rate) is $9.27 per month per $1000.00 borrowed.

Homeowners insurance is required on all Mortgage and Equity loan products.

Fixed Rate Equity Loans

Up to 80% financing available minus mortgage balance.

| Product Description | Points | Interest Rate | APR* | Monthly Payment per $1000.00 borrowed |

|---|---|---|---|---|

| 5 Year Term | N/A | as low as 5.750% | 6.296% | $19.22 |

| 10 Year Term | N/A | as low as 6.000% | 6.291% | $11.10 |

| 15 Year Term | N/A | as low as 6.250% | 6.353% | $8.57 |

| 20 Year Term | N/A | as low as 6.500% | 6.667% | $7.46 |

If your loan is paid off within two years of the closing date, you will reimburse credit union for closing costs paid on your behalf. Other rates and terms available. Offer may be discontinued or changed at any time. Not all applicants will qualify. No closing costs, member is responsible for recording fees. A fixed Home Equity Loan payment based on $10,000 at 5.75% APR for 5 years is $192.17. The payments do not include amounts for a taxes and insurance premiums, if applicable, and the actual payment obligation will be greater.

*APR = Annual Percentage Rate.

All rates are subject to change. Please call for details. Rates effective 07/01/2025.

Vehicle

Vehicle Loans

Apply NowWe offer new and used automobile loans with financing up to 100% of the cost of the new or used vehicle with loan terms up to 84 months!

Get Pre-approved today BEFORE you start shopping for your vehicle, saving you time and hassle at the dealership. A pre-approved auto loan is valid for 30 days.

New and Used Auto Rates shown are for A credit applicants financing less than 80% Loan-To-Value and include the maximum .35% relationship discount available. Additional discounts available based on Loan-To-Value. Please speak with a loan officer for more details and to see if you qualify.

New and Used Autos

| Term | Fixed APR* as low as | Monthly Payment per $1,000 Borrowed |

|---|---|---|

| 3 Years | 5.00% | $29.97 |

| 4 Years | 5.25% | $23.14 |

| 5 Years | 5.50% | $19.10 |

| 6 Years | 6.49% | $16.81 |

| 7 Years | 6.99% | $15.09 |

*APR – Annual Percentage Rate

The terms of repayment, which reflect the repayment obligations over the full term of the loan, including any balloon payment i.e. 60 monthly payments of $18.87 per $1,000 borrowed at 5.50% APR.

Motorcycles

| Product Description |

Maximum Term in Years |

Maximum Limit | Fixed APR* as low as | |

|---|---|---|---|---|

|

New/Used 2024-2025 |

5 | $40,000 | SEE LOAN OFFICER | |

| Used 2015-2023 | 5 | $25,000 | SEE LOAN OFFICER |

Recreational Vehicles

| Product Description | Term in Years | Maximum Limit | Fixed APR* as low as | |

|---|---|---|---|---|

| New/Used 2024-2025 | 6-10 | $50,000 | SEE LOAN OFFICER | |

| New/Used 2024-2025 | 5 | $50,000 | SEE LOAN OFFICER | |

| Used 2015-2023 | 5 | $50,000 | SEE LOAN OFFICER |

*APR = Annual Percentage Rate. Your actual rate may be different than the advertised rate based on your credit score.

All rates are subject to change without notice. Please call for details. Rates effective 07/01/2025.

**Other terms may be available.

Unsecured & Secured

Personal Loans

Apply NowThe terms of repayment, which reflect the repayment obligations over the full term of the loan, including any balloon payment i.e. 48 monthly payments of $26.31 per $1,000 borrowed at 11.75% APR

| Product Description | Term in Years | Maximum Limit | Rate | Monthly payment per $1000.00 borrowed |

|---|---|---|---|---|

| Personal Loans | 1 | $25,000 | as low as 8.75% | $87.32 |

| 2 | $25,000 | as low as 9.75% | $46.02 | |

| 3 | $25,000 | as low as 10.75% | $32.62 | |

| 4 | $25,000 | as low as 11.75% | $26.31 | |

| 5 | $25,000 | as low as 12.75% | $22.63 | |

| 6 | $25,000 | as low as 15.50% | $21.42 | |

| Christmas/Vacation Loans | 1 | $5,000 | as low as 8.75% | $89.24 |

| Personal Line of Credit | open end | $15,000 | Fixed rate as low as 12.875% | open end |

| Reserve Checking | 3 | $1,500 | 15.00% | $34.66 |

| Shares Pledge Loans** | 1-5 | $50,000 | 2.50% over share | |

| Share Pledge (Certificate) Loans**Can tie to a CD – same maturity date | up to CD Maturity Date | $50,000 | 2.50% over CD | |

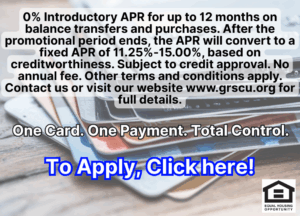

| Credit Cards – 3 options available | Low FIXED Rates | |||

| Classic | Revolving | $25,000 | as low as 11.25% | |

| Rewards | Revolving | $25,000 | as low as 13.50% | |

| Secured | Revolving | $25,000 | 15.00% |